Why entrepreneurs need to know about bank reconciliation: the best tools to do it

Being an entrepreneur is not an easy task, in any aspect of life. Those who carry out a business need to be aware of hundreds of issues, be in contact with many people, learn about very diverse topics and take care of the finances of their firm.

Regarding this last point, one of the best practices that any entrepreneur should adopt is bank reconciliation. It is an exercise that allows knowing the state of the finances, detecting accounting errors and validating the reliability of the records of the operations which are carried out.

In other words, a well-done bank reconciliation will help any company to have relevant information and a real interpretation of its business in order to make better decisions and manage resources in the most appropriate way.

What exactly is bank reconciliation?

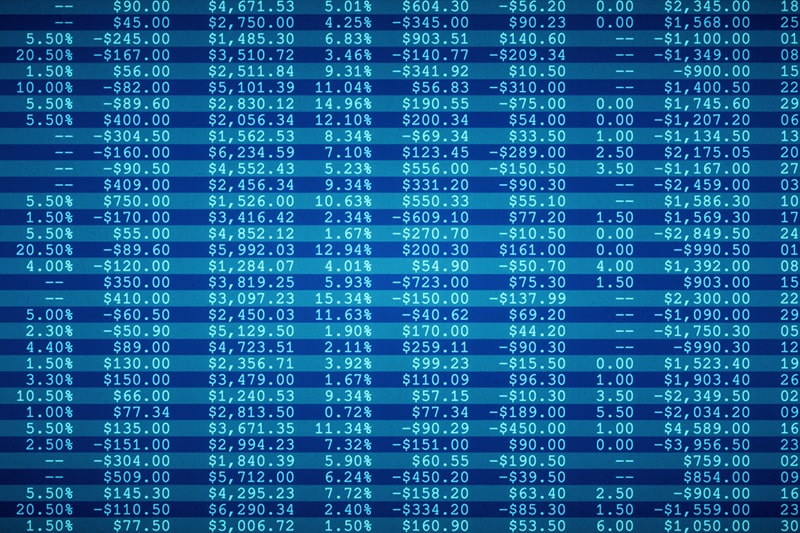

Bank reconciliation is a procedure that, although not mandatory, is recommended for all types of companies, regardless of the size or type of industry. It consists of comparing the records of the operations of the bank account that are in the accounting books with the movements registered by the banking entities in the issued bank statements that they issue. The goal is to detect anomalies and make the consequent corrections.

It is a necessary process since it is quite common for the balance of bank accounts and account statements not to match with what is recorded in the books. This is because, for example, what a company registers can be accounted for days later in the bank.

For this reason it is important to note that bank reconciliations are not intended to match in their entirety, considering the bank balances on file for the company with the statements of those accounts. Its purpose, on the contrary, is to determine what it is that has generated that difference.

Despite its usefulness, bank reconciliation can be a long and cumbersome process, which is why some companies neglect it or do it very infrequently. It is essential not to let too much time pass between one reconciliation and another, since, the more time passes, the more difficult it will be to reconcile the accounts, check invoices or contact suppliers or clients if necessary.

If you need to check that your company’s accounting information is true and matches your account balances, there are tools with which you can effectively reconcile.

Bank reconciliation in Excel

How to start a conciliation? First of all, it is necessary to have three elements: the accounting books up to date, the bank statement and the reconciliation document. This document can be developed in a spreadsheet, especially when the company is taking its first steps.

The design of the spreadsheet to upload the reconciliation is very simple. You should only contemplate the date, the concept or transaction carried out and the amounts registered both in the accounting book and in the bank account statement. Then, all operations are compared to see if they match.

Although this is a simple way to solve the process, the use of spreadsheets presents a big problem which is scalability. If your business begins to have too many transactions or movements, this option can consume many hours, with the additional risk of making mistakes. In that case, it is necessary to adopt a tool that helps you automate reconciliation.

Automate bank reconciliation

A software that performs bank reconciliations in an automated way reduces the risk of committing human errors and facilitates their detection or solution in case they persist. Therefore, it also allows you to save time and effort, and even carry out reconciliations more frequently.

It is that, in business, time is money, especially when it comes to processes that we must carry out every month. In fact, one of the ways to become a more efficient company is through technologies that simplify the management of tasks that can be automated.

By reducing the complexity and the time spent on repetitive tasks, then, employees will be able to spend their time adding more value to the company, which will result in greater profit.

If your volume of data makes management of this type unfeasible or if you need to improve and automate some of these processes, a technological solution such as Conciliac’s can be of great help. With Conciliac EDM it is possible to automate reconciliation processes, not only accounting or banking, but also inventories, payroll or any type of process that requires matching great volumes of data. The result is increased productivity, considerable cost efficient, avoiding human errors and allocating your team’s time to tasks that add value.

If you want to know more, do not hesitate to contact us.